Sustainability in financial services: The evolving UK talent market

Rising to the challenge: sustainability professionals in UK financial services

The landscape of sustainability within the financial sector is undergoing a dynamic transformation, driven by a growing commitment to environmental, social, and governance (ESG) principles. Recent data reveals key trends and insights into the professionals at the heart of this change. Here’s a closer look into what these people do, the demographics, career dynamics and educational backgrounds shaping the sustainability sector in UK financial services, banking, venture capital, and private equity.

Sustainability as a career

A career in sustainability within financial services offers professionals the opportunity to drive impactful change at the intersection of finance, sustainability and strategy. These individuals strategise, analyse and integrate environmental, social, and governance factors into investment strategies and business operations, ensuring financial decisions align with sustainable development goals and regulation. They engage with clients and stakeholders to promote responsible investing practices, manage risks associated with climate change and other sustainability challenges, identify opportunities and advocate for transparency and ethical standards in financial markets. Sustainability professionals in financial services play a pivotal role in shaping a more resilient and equitable global economy, making this career path both rewarding and vital in today’s evolving landscape.

A female-dominated field

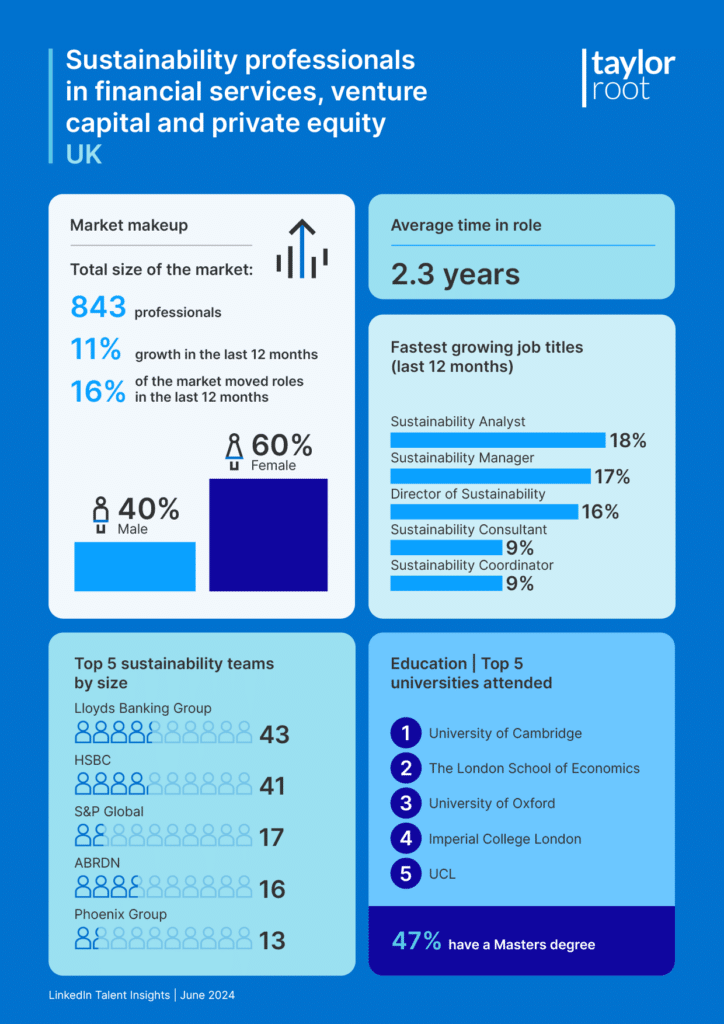

Interestingly, women are leading the charge in sustainability roles within the financial sector, making up 60% of the workforce. This is quite a contrast to the male dominant nature of financial services a whole. This gender distribution highlights the inclusive nature of sustainability fields, perhaps reflective of broader societal trends towards gender equality in leadership positions and the inherently collaborative nature of sustainability work.

Career mobility and tenure

Sustainability professionals tend to be relatively new to their roles, with an average tenure of 2.3 years. This suggests a vibrant, fast-evolving field where new strategies and innovative practices are continually being introduced. Furthermore, the sector sees considerable mobility, with 16% of professionals having moved to new roles within the past year. This high rate of movement indicates both the demand for talent and the dynamic nature of sustainability careers.

Leading teams and key players

The largest sustainability teams are found within some of the UK’s most prominent financial institutions. Lloyds Banking Group leads with 43 professionals, followed closely by HSBC with 41. Other notable teams include S&P Global (17), abrdn (16), and Phoenix Group (13). These numbers underline the substantial investment these companies are making in sustainability, recognising its critical role in future-proofing their operations and addressing stakeholder expectations.

Job titles and growth

The most common job titles in the sector are Head of Sustainability (31%), Sustainability Manager (25%), and Director of Sustainability (16%). These roles reflect a broad spectrum of responsibilities from strategic oversight to operational management and consultancy.

In terms of growth, the title of Sustainability Analyst saw an 18% increase over the past year, the highest among all roles, indicating a growing demand for data-driven insights in sustainability. Sustainability Manager and Director of Sustainability roles also saw significant growth, at 17% and 16% respectively, signalling an expansion in both middle management and senior leadership positions.

Businesses are investing in high-level roles within ESG and sustainability to embed sustainable practices into their core operations and strategy. Titles such as Head of Sustainability, Sustainability Manager and Director of Sustainability underscore the importance of dedicated leaders who provide strategic oversight, manage operational efforts and offer expert consultancy or advisory. The 18% growth in Sustainability Analyst roles highlights the demand for data-driven insights, crucial for informed decision-making. Similarly, the 17% and 16% growth in Sustainability Manager and Director of Sustainability roles indicate the need for robust middle management and senior leadership to navigate sustainability complexities.

Businesses seek a diverse skill set when hiring ESG and sustainability professionals. Analytical skills are essential for Sustainability Analysts to interpret complex data. Strategic thinking and leadership are vital for senior roles to develop and implement long-term strategies. Operational management skills are crucial for Sustainability Managers to execute daily projects effectively. Additionally, expertise in regulatory compliance, stakeholder engagement, and environmental impact assessment is highly valued. By investing in professionals with these skills, businesses can meet regulatory requirements, fulfil stakeholder expectations, and gain a competitive edge in a sustainability-driven market.

Geographical distribution

London is the epicentre of sustainability roles in the UK, with 549 professionals based in the capital. Other cities with notable concentrations of sustainability experts include Edinburgh (47), Manchester (18), Leeds (15), and Birmingham (10). This distribution highlights London’s status as a global financial hub while also showing emerging sustainability centres across the UK.

Educational backgrounds

Education plays a crucial role in shaping sustainability professionals. The top universities attended by these professionals include prestigious institutions such as the University of Cambridge, The London School of Economics, and the University of Oxford. Nearly half (47%) of these professionals hold a master’s degree, underscoring the advanced level of expertise in the field.

The most common degrees among sustainability professionals are in Economics, Sustainability Studies, and Environmental Studies. This diverse academic background equips them with a comprehensive understanding of both the economic impacts and environmental imperatives crucial to sustainable finance.

Where to next?

The field of sustainability within the UK financial services sector is characterised by a dynamic, growing, and predominantly female workforce. Professionals are well-educated, highly mobile, and situated primarily in major financial hubs. With leading institutions investing heavily in sustainability teams and an increasing demand for analytical and managerial roles, the future of sustainability in finance looks robust and promising. As these trends continue, the integration of sustainability into the core operations of financial institutions will likely accelerate, driving significant positive impacts on both the environment and society.

Looking to hire?

If you have a role you would like to speak to us about, please submit the details here.