What do the Data Engineering and Data Science workforces within insurance look like?

In recent years, the insurance industry has undergone a significant transformation, leveraging advancements in technology and data to revolutionise operations and enhance competitiveness. Data plays a crucial role in decision-making processes across various functions, from underwriting and claims processing to customer engagement and risk management.

We have taken a snapshot of key data points on demographics, career trends, and educational backgrounds and this reveals intriguing themes and opportunities.

Data Science and Data Engineering trends:

Gender gap

The data reveals distinct patterns in the demographics and qualifications of professionals in Data Science and Data Engineering roles within the insurance sector. The key and most notable factor, which is being discussed by the industry with more fever than ever before, is the gender gap.

Whilst improvements have been made over the past few years, the industry is still lagging behind competitive industries such as banking and financial services.

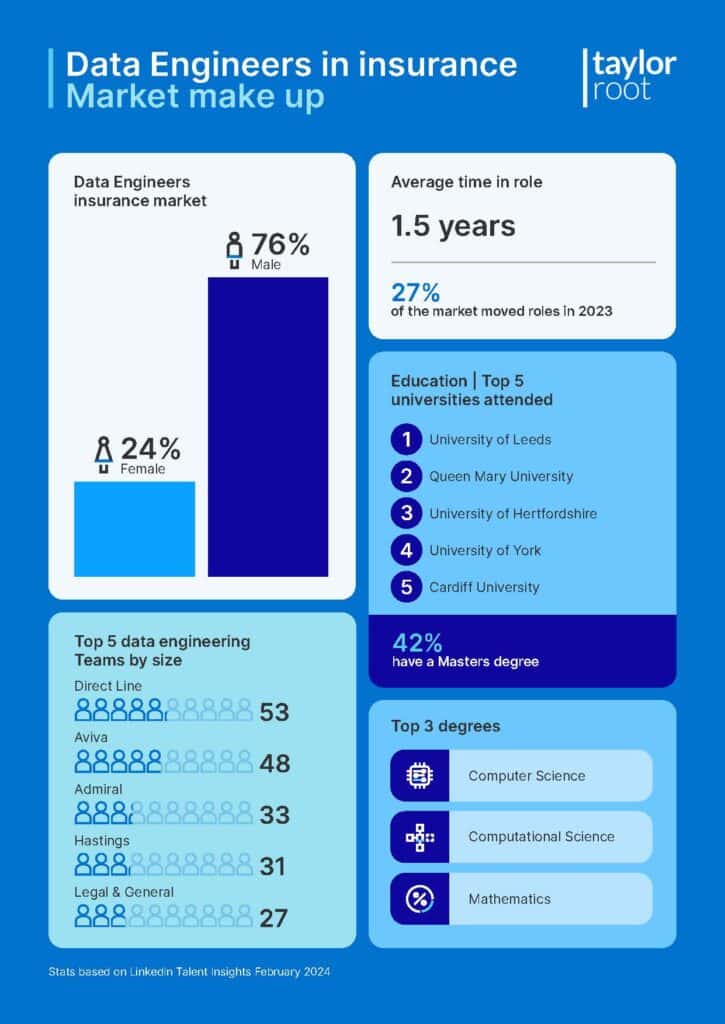

Within the UK insurance market, women represent 24% of Data Engineers and 27% of Data Scientists, which is somewhat below banking, 34%, and financial services at 31%. Both of these industries have a much larger workforce which highlights further the gap in this figures.

Typically the gender gap is attributed to:

- Historical gender bias

- Educational disparities

- Societal expectations and stereotypes.

- Workplace culture and bias

- Lack of role models and mentorship

However, whilst the market itself is making head way to address these issues, one of the fundamental areas the industry needs to address is how it is selling itself. The gender gap needs to be reduced, that doesn’t need to be explained, however, what is the industry doing to attract not just talent but female talent. Insurance companies need to look inwardly on how they are promoting themselves to make it an appealing destination for female data professional’s.

Moving workforce

The data underscores the dynamic nature of these roles, with a considerable portion of professionals moving roles. In 2023, 27% of Data Engineers and 32% of Data Scientists in the insurance market moved roles.

With the majority of insurers increasing their headcount within their data teams, it is unsurprising to see talent move and poached by competitors.

Strong education

Educationally, a significant proportion of professionals in both Data Engineering and Data Science roles hold advanced degrees, with a notable emphasis on Master’s level qualifications. In Data Engineering, 42% of professionals hold a Master’s degree, while in Data Science, this figure rises to 59%. The top three degrees among Data Engineers are in Computer Science, Computational Science, and Mathematics. Similarly, Data Scientists predominantly have degrees in Mathematics, Data Science, and Physics, reflecting the interdisciplinary nature of these roles.

Implications for the insurance industry:

These insights carry profound implications for insurance companies seeking to harness the full potential of data-driven technologies. By understanding the demographic composition, educational backgrounds, and career trajectories of Data Science and Data Engineering professionals, insurers can tailor recruitment strategies, talent development programs, and retention initiatives to attract and retain top talent effectively.

Moreover, the prevalence of Master’s level qualifications underscores the importance of investing in continuous learning and upskilling initiatives within organisations. By providing employees with opportunities to pursue advanced education and certifications in relevant fields, insurers can cultivate a highly skilled workforce capable of driving innovation and navigating the complexities of an evolving industry landscape.

Additionally, the data highlights the need for collaborative approaches that bridge the gap between Data Science and Data Engineering functions. By fostering synergy and cross-functional collaboration between these teams, insurers can accelerate the development and deployment of data-driven solutions, leading to enhanced operational efficiency, improved risk management, and superior customer experiences.

We have a team of consultants dedicated to working with insurers and other businesses across banking and financial services to build their data teams. For more information on this market please contact Duncan Kennedy.